Legislators in Alabama passed a number of measures this year, one of which provides a significant new benefit for state employees and teachers, and it goes into effect on Tuesday.

The tax exemption on overtime pay, which was another Alabama rule that let many hourly workers put extra money in their pockets, has ended.

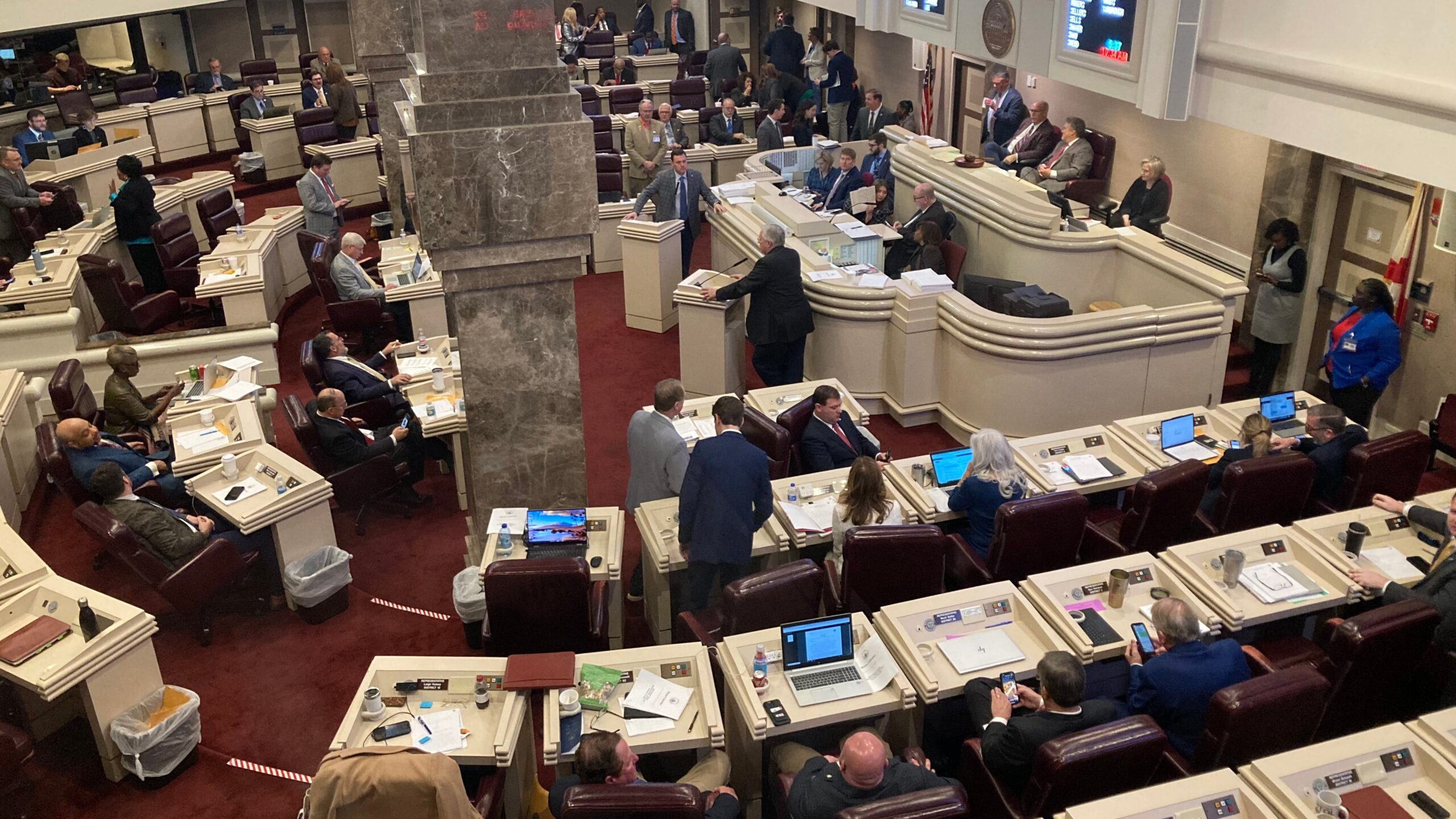

During the legislative session that concluded in May, Governor Kay Ivey signed 287 measures into law.

Many of them have already taken effect. Later this year, others will follow suit.

A few go into effect on July 1st:

Paid time off for parents

Senator Vivian Davis Figures, D-Mobile, introduced SB199, a bill that would provide paid parental leave to state and education employees following the birth of a child.

Following a birth, stillbirth, or miscarriage, mothers will be entitled to eight weeks of paid leave.

In those situations, fathers will be eligible for two weeks of paid leave.

Additionally, parents who adopt a child under the age of three will be eligible for paid leave.

Rep. Ginny Shaver, a Republican from Cherokee County, sponsored the bill in the House, and it passed by a large majority.

In order to address rising staff turnover rates, the Governor’s Study Group on Efficiency in State Government issued a final report in 2023 that included a number of recommendations, including paid parental leave.

During her top of the state speech in February, Ivey urged the law to be passed.

In the absence of parental leave, workers took unpaid leave or used sick days to care for a newborn or adopted child.

According to A Better Balance, a nonprofit legal advocacy group, Alabama is the 39th state to offer paid parental leave to state employees.

Prohibition of smoked hemp

Rep. Andy Whitt, R-Harvest, has introduced a bill (HB445) that prohibits the sale of smokable hemp goods, which include flowers, buds, and pre-rolled cigarettes. These items have been the top sellers for certain hemp specialty stores.

Starting Tuesday, the law would make selling or possessing smokable hemp a Class C felony, with a sentence of one to ten years.

The Montgomery County Circuit Court has been asked to block parts of the statute by four businesses that manufacture and sell the items.

The businesses argue in the Friday complaint that any state law that would forbid the transfer and export of hemp through interstate commerce is superseded by federal law, which legalizes the crop.

Among other things, the companies claimed that the new law is ambiguous.

The motion to issue a temporary restraining order against the law was refused by Judge James Anderson.

Gummies, beverages, and other products that contain synthetic THC derived from hemp, including smokable hemp, are prohibited as of Tuesday.

The Alabama Alcoholic Beverage Control Board is required by HB445 to establish licensing and rules for edible hemp that is not prohibited.

January 1, 2026 is the date on which the ABC Board regulations go into force.

Demolition of the State House

Directly behind the 60-year-old structure it is replacing, on Montgomery’s Ripley Street, a new Alabama State House is being built.

The State House is being constructed by the Retirement Systems of Alabama and is anticipated to be completed in time for the 2027 legislative session at a cost of roughly $300 million.

In addition to any extraordinary sessions the governor may call, lawmakers will hold one more annual session in the old State House if the construction schedule holds. It will then be demolished and replaced with a park or other open area.

HB279, a statute that goes into effect on Tuesday, gives the Legislative Council the authority to enter into a contract for that demolition.

Additionally, the bill, which was introduced by Madison County Republican Senator Sam Givhan, permits the sale of certain objects in the old State House to lawmakers and staff members as well as the disposal of other items included in the facility.

Built for the Alabama Highway Department in the early 1960s, the State House is a renovated structure.

Building a prison

Sen. Greg Albritton, a Republican from Atmore, has introduced a bill that would expand the state’s borrowing capacity for jail construction by $500 million.

The Alabama Corrections Institution Finance Authority’s bond debt maximum is increased from $785 million to $1.285 billion by SB60.

The Kay Ivey Correctional Complex, a 4,000-bed specialty care men’s jail in Elmore County, was constructed with the assistance of $509 million in bonds that the authority sold in 2022.

It is anticipated that the prison will be finished the following year.

To assist with the construction of a second 4,000-bed men’s jail in Escambia County, the state anticipates borrowing more funds through a bond issue.

In 2021, the Legislature authorized $1.3 billion for both institutions.

However, following an initial estimate of $623 million, the Elmore County prison’s cost increased to just over $1 billion.

Because of this, lawmakers had to find more money for Escambia County’s second prison.

The timing and size of the bond issue for the Escambia County prison have not yet been determined, according to Sen. Greg Albritton, R-Atmore, who is the sponsor of the bill that would raise the bond debt limit.

Read more: The new $1 billion prison in Alabama will be bigger than many county seats.

Exemption from overtime taxes expires

House Minority Leader Anthony Daniels, a Democrat from Huntsville, introduced a plan to exempt overtime pay from the state income tax, which was approved by the Legislature in 2023.

In November 2023, business officials and leaders from both parties attended a ceremonial law signing at the Hyundai facility in Montgomery.

They applauded the bill for helping firms who were having trouble filling positions and for allowing workers to keep more of their earnings.

However, the exemption significantly decreased state income tax collections after it went into force in January 2024.

In the first 16 months of the exemption’s implementation, through April, workers claimed $387 million, according to the most current report on the exemption from the Alabama Department of Revenue.

The largest source of funding for public schools comes from state income taxes. Because it was unclear how much the exemption would impact school financing, lawmakers allowed it to expire on June 30, a sunset date that was included to the bill back in 2023.

This year, Daniels, the measure’s sponsor, proposed a second bill to extend the exemption and request an analysis of the total economic impact. However, his bill did not move further.

Read more: Alabama Paper Plant Technician: We shouldn’t lose our overtime tax exemption

Instead, other tax cuts were backed by Republican lawmakers.

A bill to lower the state sales tax on food from 3% to 2% was approved by lawmakers.

An estimated $120 million is saved annually by taxpayers.

This year, lawmakers approved a second bill to exempt feminine hygiene products, diapers, baby formula, and other goods from the 4% state sales tax.

It is anticipated that taxpayers will save almost $13 million annually.

The exemption for infant items and the reduction in the food tax go into effect on September 1.

View more: The most recent laws in Alabama: In the 2025 legislative session, Kay Ivey signed these legislation.